ジャンプリンクテキスト

| Read more articles from the January 2016 Energy Update newsletter > |

California has become the front-runner in what may be termed the “duck curve revolution,” due to the plunge in photovoltaic panel prices over the last several years, paired with regulatory incentives to increase the proportion of renewables, including a statutory mandate to have 50% of generated electricity come from renewable sources by 2030. Green power advocacy groups have long pushed for an increased share of renewables in California’s energy mix. The legislature responded, adopting SB350—the Clean Energy and Pollution Reduction Act of 2015—on October 7, 2015. The Act increased the proportion of renewable energy required to be in place by 2030 from 33% to 50%.1 Going further, Governor Jerry Brown announced a goal of reducing emissions to 40% below 1990 levels by 2030. California’s solar industry has also responded, with large-scale solar accounting for 7,000 MW in 2015 and rooftop residential and business accounting for 3,000 MW.2

All of this new emphasis on solar power has displaced (and will continue to displace) conventional power generation, which has the California Independent System Operator (CAISO) concerned about demand response, grid reliability and frequency regulation. These three risks and the behavior of the net load curve have created significant demand for rapid response power generation, which, in today’s energy world, effectively means gas-fired generation. For an example of the inherent tension in building new gas-fired power plants as part of the solar boom, look no further than the political debate surrounding the April 2015 approval of the 500-MW Encina gas peaker station.3

What in the World Is the “Duck Curve?”

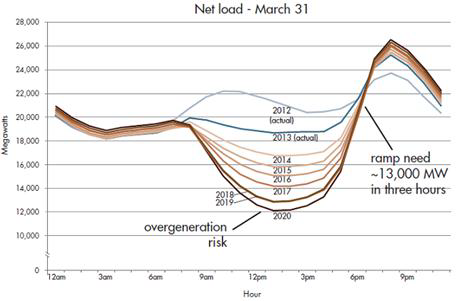

The “duck curve” is an industry moniker popularized by CAISO to describe the shape of the net load curve of variable generation demand as renewable sources connect to the grid. The curve includes four distinct ramp-up and ramp-down periods in a typical day, particularly aggravated in the “shoulder” months in the spring and fall, when baseload will typically not be significant due to the temperate climate. Below is an example of the duck curve from CAISO for what would be a typical March day.

Source: https://www.caiso.com/Documents/FlexibleResourcesHelpRenewables_FastFacts.pdf

According to CAISO, the neck of the curve represents an additional 13,000 MW that kick in just as the sun sets. CAISO sees three significant risks to system integrity arising from the duck curve:

Ramping: Accelerated up and down ramping requires variable resources with quick on and off times.

Overgeneration: In the middle of the day, when the sun shines and the wind blows, renewables will feed into the grid, posing a challenge to grid integrity.

Frequency regulation: Difficulty in operating and adjusting to maintain constant frequency (e.g., 60 hertz in CAISO).

In order to mitigate the risks above, CAISO and other energy players (including the three big investor-owned utilities and the California Public Utilities Commission) have been pushing an array of products and technology initiatives, including the following: Flexible Ramping Product: This product will allow CAISO to procure ramping capacity through a special 15-minute interval market. The product was initially requested by the CAISO board in April 2011 and is still in stakeholder discussions.4

Distributed Energy Resources: Distributed energy resources with smart metering, small-scale storage (including with electric vehicles), rooftop solar and energy response will need to be integrated in a distributed, managed system.

Gas as a Solution

Gas-fired power plants are suited to address the needs of energy markets in the age of the duck curve. With cold start times of under 10 minutes, spinning reserves, automatic frequency regulation and other ancillary services, gas plants can ramp up and down quickly to meet variable response and supply. Paired with a predicted long-term trend in low gas prices and, particularly in California, scarce hydro, gas-fired power plants may have a bright future in solar-dominated California, although gas, as a fossil fuel, does not quite fit into the renewable mandate.

Challenges Faced by Gas-Fired Plant Owners and Operators

All is not rosy, however, for gas-fired plant owners and operators. The particular characteristics of the duck curve do pose significant challenges. On the technical side, the rapid ramp-up and ramp-down and frequent stops mean that existing plants are not necessarily operating as designed, i.e., at full load or as a baseload plant. Combined cycle plants, fitted out with boilers cogenerating electricity from waste heat, are not designed to operate as peakers for two to three hours a day, which is what the duck curve would seem to require. The increased number of starts and stops may well lead to higher maintenance costs and a shorter useful life for gas turbines.

Commercially, the duck curve poses a number of interesting challenges to gas plant owners and operators and their lenders. Most gas plant owners prefer long-term, fixed-price power purchase agreements with reliable offtake parties, partly in order to finance construction. The greater volatility in short-term trading markets effectively means that the lenders are more likely to favor shorter tenors and greater equity commitments. Furthermore, there is considerable uncertainty as to what the duck curve will actually look like, as there are a number of variables at play, including demand response, advanced inverters, export markets and purchases from neighboring ISOs (which will be going through their own duck curve transformations), improved storage technology, etc. All of these factors may well help to “flatten” the duck curve.

1 https://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=201520160SB350

2 http://www.bloomberg.com/news/articles/2015-10-21/california-s-duck-curve-is-about-to-jolt-the-electricity-grid

3 https://www.greentechmedia.com/articles/read/California-PUC-Approves-500MW-of-Gas-For-SDGE-in-Carlsbad-Rejects-Alterna

4 http://www.caiso.com/informed/Pages/StakeholderProcesses/

FlexibleRampingProduct.aspx