Jump to...

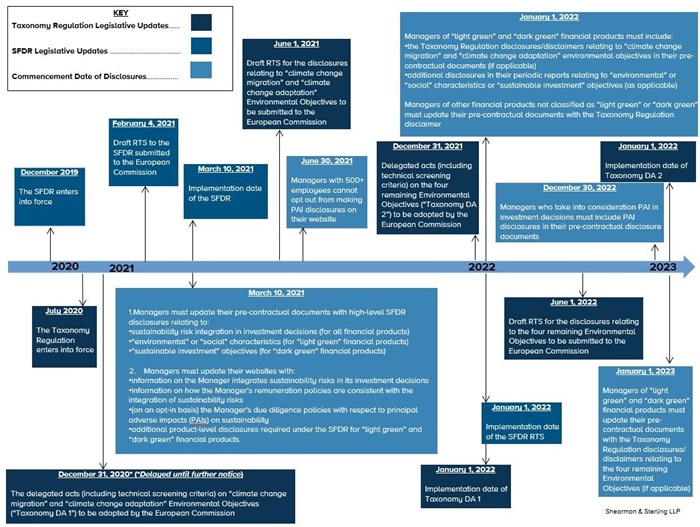

Beginning on March 10, 2021, EU fund managers and certain non-EU fund managers became subject to various new sustainability-related rules, by virtue of the EU’s Sustainable Finance Disclosure Regulation (SFDR).[1]

Over the coming months and years, other obligations will be imposed on managers both by the SFDR itself (as those obligations phase in) and by the EU’s separate Taxonomy Regulation.[2]

The SFDR and the Taxonomy Regulation (collectively, the “ESG Regulations”) form part of a package intended to move sustainable investment objectives to the core of the financial system in the EU, and to help end investors analyze and judge financial products by reference to social and environmental impact and sustainability.

The primary focus of this note will be on the main rules applicable to AIFMs.

For fund managers, the required disclosures can be bundled into three separate categories:

Again, the intention here is that these disclosures will effectively supplement the existing disclosures required to be made in a manager’s periodic report under the relevant regulatory framework. For AIFMs, these disclosures will be made in the annual report required under Article 22 of AIFMD, and for MiFID investment firms they will be made in the periodic reports provided to clients in accordance with Article 25(6) of MiFID.

As with the website disclosures, these periodic report disclosures only clearly apply to EU fund managers, but it would be somewhat anomalous if they did not also apply to non-EU fund managers that are required (e.g. by virtue of AIFMD) to prepare periodic reports anyway.

The Final Report on the draft Regulatory Technical Standards published on February 4, 2021[7] provides in draft form the regulatory technical standards described in the SFDR (the “ESG Disclosures RTS”).

The ESG Disclosures RTS prescribe, in granular detail, how certain of the disclosures under the SFDR have to be made: in content, methodology and presentation. Originally, it was intended that the ESG Disclosures RTS would apply from March 10, 2021. However, the ongoing Covid-19 pandemic has resulted in a delay finalizing the draft ESG Disclosures RTS.

The ESG Disclosures RTS provide very useful guidance for managers on how to comply with the SFDR disclosure obligations that come into application on March 10, 2021, but the detailed templates contained in the ESG Disclosures RTS will not strictly be required to be used until (at the earliest) January 1, 2022.

Through necessity, this note refers to obligations contained in the draft ESG Disclosures RTS as at the date of this note, and to the currently expected timeline for their application. This is, unfortunately, subject to change and potential delay.

From March 10, 2021, Managers must include in their pre-contractual disclosures for each fund or account:

Sadly, there is no clear explanation in the SFDR as to when a particular product will be considered to be promoting “environmental” or “social” characteristics. Greater clarity may well come from the EU Commission or from ESMA. Broadly, at this stage, it is fair to assume that this will capture products which apply ESG strategies in their investment process, including investment selection, but do not commit to having ESG objectives.

From March 10, 2021, if a fund or account is promoted as having environmental or social characteristics, the Manager must include in its pre-contractual disclosures:

From January 1, 2022, this information must specifically follow the content, methodology and presentation prescribed by the ESG Disclosures RTS.

From March 10, 2021, where a fund or account has “sustainable investment” as its stated objective, the Manager must include in its pre-contractual disclosures:

From January 1, 2022, this information must specifically follow the content, methodology and presentation prescribed by the ESG Disclosures RTS.

From January 1, 2022 or January 1, 2023 (see below), for Managers whose funds or accounts promote “environmental” or “social” characteristics, or that have “sustainable investment” as their objective, the Manager must additionally include in its pre-contractual disclosures:

For this purpose, “environmentally sustainable” investments are those that:

The technical screening criteria will be developed via delegated acts, the first of which will be in relation to the two Environmental Objectives “climate change mitigation” and “climate change adaption”—and is expected to come into effect on January 1, 2022. The Taxonomy Regulation disclosures are thus expected to apply to funds and accounts that make investments with “climate change mitigation” and/or “climate change adaption” objectives from this date.

The technical screening criteria for the remaining four Environmental Objectives is expected to come into effect from January 1, 2023. Funds and accounts that make investments with any of the remaining four Environmental Objectives will therefore be expected to make the Taxonomy Regulation disclosures from this date.

From January 1, 2022 or January 1, 2023, as applicable, Managers of “light green” or “dark green” financial products must include the following specific disclaimer in their pre-contractual disclosures and periodic reports:

“The ‘do no significant harm’ principle applies only to those investments underlying the financial product that take into account the EU criteria for environmentally sustainable economic activities.

The investments underlying the remaining portion of this financial product do not take into account the EU criteria for environmentally sustainable economic activities.”

From January 1, 2022, other financial products captured by the SFDR that are not classified as “light green” or “dark green” must include the following disclaimer in their pre-contractual disclosures and periodic reports:

“The investments underlying this financial product do not take into account the EU criteria for environmentally sustainable economic activities.”

From December 30, 2022, the Manager must include in its pre-contractual disclosures for each fund or account:

From March 10, 2021, Managers must publish on their website information about their policies on the integration of sustainability risks in their investment decision-making process (or upload the entire policy).

From March 10, 2021, Managers must publish on their website information explaining how their remuneration policies are consistent with the integration of sustainability risks, including with respect to:

From March 10, 2021, Managers who take into consideration the PAI of investment decisions on sustainability factors must publish a statement on the firm’s due diligence policies with respect to PAI when making investments, including:

Managers who do not take into consideration the PAI of investment decisions on sustainability factors must publish clear reasons as to why they do not do so, including, where relevant, information as to whether and when they intend to consider PAI.

From June 30, 2021, Managers with more than 500 employees (including as a parent of a group) will have no choice but to take PAI into consideration. Others below this threshold may still choose not to do so.

At the time of writing, it is unclear whether this 500-employee threshold is assessed only by reference to EU entities in the group, or by reference to both EU and non-EU group entities. Further clarification from the EU Commission has been sought.

From January 1, 2022, the website disclosures must follow the specific content, methodology and presentation prescribed by the ESG Disclosures RTS.

The ESG Disclosures RTS establish a framework of reporting on PAI by June 30 each year, requiring (except in the first year) some of the information to be disclosed by way of reference to the previous calendar year(s), including a historical comparison covering up to five reference periods. The result is, for Managers who either opt in to consider PAI from March 10, 2021 or are required to publish a PAI statement from June 30, 2021:

From March 10, 2021, Managers with “light green” or “dark green” products in their portfolio must publish and maintain on their websites:

From January 1, 2022, the above information must follow the content, methodology and presentation prescribed by the ESG Disclosures RTS.

Many Managers do not make any meaningful information publicly available on their websites, and for good reason—in many jurisdictions, doing so potentially infringes restrictions on marketing and public solicitation.

The SFDR obligation to publish detailed disclosures relating to the Manager and its financial products on the Manager’s website, therefore, puts the Manager in a potentially difficult situation.

In the absence of clear guidance or rulemaking from relevant EU supervisory bodies, we consider that making the SFDR-required information available only behind a password-protected firewall (or putting behind that firewall at least any of the SFDR-required information that would, if made public, jeopardize the Manager’s ability to retain its “no public solicitation” stance) is a reasonably justifiable position for a Manager to take.

From January 1, 2022, Managers with “light green” or “dark green” products in their portfolio will need to include the following additional information in their periodic reports:

This information should be included in a separate annex to the Manager’s periodic reports, and the main body of the reports should include a statement that information on the environmental or social characteristics, or the sustainable investment objective (as applicable), is available in that annex.

The annex to the periodic report must follow the specific content, methodology and presentation prescribed by the ESG Disclosures RTS.

The intention behind the ESG Regulations is not just to add yet more regulatory burden, but to seemingly force fund managers to gradually take ESG considerations into account in their investment processes. By requiring Managers to make advance disclosures to investors explaining how they take ESG factors into account, and then report how successful they were in achieving their goals by way of reference to these disclosures, the EU is ensuring fund managers are held accountable for their ESG-driven decisions or lack thereof.

While these rules do not currently automatically apply to U.K. fund managers, the world is increasingly becoming more ESG-focused, and the U.K. can be expected in the near future to impose ESG-driven requirements on its own fund managers.

Special thanks to Shearman & Sterling trainee Fraser Padmore for his contribution to this client publication.

[1] See Regulation (EU) 2019/2088 of 27 November 2019.

[2] See Regulation (EU) 2020/852 of 18 June 2020.

[3] See Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014.

[4] See Directive 2009/65/EC of the European Parliament and of the Council of 13 July 2009.

[5] See Directive 2011/61/EU of the European Parliament and of the Council of 8 June 2011.

[6] See Agreement on the European Economic Area, 3 January 1994.

[7] See The Joint ESAs Final Report on RTS under SFDR, dated 4 February 2021.

[8] A “sustainability risk” is an environmental, social or governance event or condition which, if it occurs, could cause a material negative impact on the value of an investment.

[9] See Paris Agreement to the United Nations Framework Convention on Climate Change, 12 December 2015.

[10] The “Environmental Objectives” are: climate change mitigation; climate change adaption; the sustainable use and protection of water and marine resources; the transition to a circular economy; pollution prevention and control; and the protection and restoration of biodiversity and ecosystems.

Practices

Industries

Regional Experience

Key Issues