Jump to...

The UK’s beneficial ownership disclosure rules for persons with significant control (PSCs) over certain UK entities, introduced in April 2016, have been extended as part of the UK’s implementation of the EU’s Fourth Anti Money Laundering Directive (4MLD). These rules now apply to additional UK companies and entities and require beneficial ownership information to be updated and publicly filed within prescribed 14 day time periods. This publication sets out the main features and requirements of these rules (the so-called PSC regime) following these changes.

The PSC regime requires, among other things, certain UK entities to maintain a publicly available register of PSCs (the PSC register) and to make public filings in respect of it.

26 June 2017 – new regulations take effect to introduce the changes to the PSC regime as set out below

26 June 2017 - annual confirmation statements filed on or after this date by companies no longer have to set out details of their PSC registers but instead must confirm that all notifications of changes to their PSC register have been filed with the Registrar of Companies

9 July 2017 – companies and others already required to keep PSC registers before 26 June 2017 and that needed to update the register as at that date, had to complete the update by this date

9 July 2017 – companies that had updated their PSC register before 26 June 2017 had to notify the update to the Registrar of Companies by this date

24 July 2017 – additional companies and other entities caught by the extended PSC regime (see below) have to start keeping and updating their PSC registers

7 August 2017 – the date by which UK entities mentioned below which became subject for the first time to PSC register keeping requirements on 24 July 2017, have to file with the Registrar of Companies the details of the PSCs they entered on their PSC registers on that date

UK companies with shares traded in the UK but not on a regulated market (e.g. AIM-traded companies), companies not registered under the Companies Acts and certain Scottish partnerships are now subject to the PSC regime

New prescribed time limits apply to making up or updating a PSC register—this must now be done within 14 days of the company having all the required particulars and those must then be filed publicly with the Registrar of Companies within a further 14 days.

The PSC Register

The Principles Underlying the PSC Register

From 6 April 2016, subject to certain exemptions mentioned below, UK registered companies, limited liability partnerships (“LLPs”) and societates europaeae (“European Companies” or “SEs”) have had to establish and maintain a statutory register of persons with significant control over them (“PSCs”), i.e. a PSC register. From 24 July 2017, UK “unregistered companies” (i.e. not incorporated under the UK Companies Act 2006) and certain Scottish partnerships have also had to establish and maintain a PSC register. In addition, certain UK companies that previously did not have to maintain a PSC register (e.g. AIM-traded companies) now have to do so. The revised guidance about keeping PSC registers that has been issued to take account of these changes—see “What is Significant Influence or Control?” below—indicates that 26 June 2017 should be the date to be recorded on the PSC register as the date when persons who held their interests in these newly in scope entities as at that date became registrable.

While the basic principles behind the PSC regime may be relatively straightforward, the detailed legal rules setting out the regime—particularly as they apply to complex corporate structures, as opposed to wholly-owned group structures—are quite complex.

Even though the rules are primarily designed to require the disclosure of beneficial ownership or control by individuals of private or unlisted UK companies, they are still relevant to listed groups of companies with UK subsidiaries and, as mentioned above, also to certain publicly traded UK companies which are not traded on an EEA-regulated market. UK subsidiaries of listed parents are required to keep a PSC register and include in it details of their parent company as their significant owner or controller (as explained below).

Updating the PSC Register and Public Access to It

The register is open to public inspection and, following the changes made to the PSC regime mentioned under “Key Changes” above, any changes to the details on the register have to be updated within 14 days of the company becoming aware of them. Details of any updates have to be filed publicly with the Registrar of Companies within a further period of 14 days after the PSC register has been updated.

When a company files with the Registrar of Companies its annual confirmation statement confirming, for the public record, its key corporate information (e.g. directors, shareholders and share capital, etc.), it must now confirm that it has filed with the Registrar all the PSC register information mentioned above. Previously, UK companies were required to confirm in this annual statement the information currently recorded on their PSC register.

PSCs and RLEs

A company’s PSC register must always disclose whether or not the company has any PSCs, and by definition these people will always be individuals (i.e. natural persons) who have certain interests in or a level of control over the company, whether held directly or indirectly.

RLEs and RRLEs

However, in certain cases mentioned below (see “Holdings or Interests Held by Legal Entities Which are RLEs” below), where: (i) an individual has “significant control” over a company indirectly through a chain of companies, or (ii) there is no such individual in relation to the company required to keep the PSC register (e.g. in the case of listed group of companies with no controlling shareholder), instead of registering an individual as a PSC, the company may be required to register a legal entity (a “Relevant Legal Entity” or “RLE”) which has significant control over the company, whether directly or indirectly. This will be the case where the interest or control held by the legal entity would have made it registrable as a PSC if it had been an individual and where that entity is itself subject to certain public disclosure requirements with respect to its own beneficial owners or controllers (including, if it is a UK incorporated entity, through having to keep its own PSC register).

Not all RLEs will be registrable on a PSC register. Where there is a chain of indirect holdings held by RLEs in a company, only the first RLE in the chain will generally be registrable (this registrable RLE is referred to below as an RRLE), the idea being that the public can then see from the “look-through” public ownership records or disclosures of that RRLE who controls it and therefore who indirectly controls the company itself (see “Holdings or Interests Held by Legal Entities which are RLEs” below).

Key principles underlying the PSC regime (described in the rest of this note) therefore include:

when a person is to be taken to have “significant influence or control” over a company,

when a person is to be taken to have an “indirect” interest in a company, and

which legal entities are to be treated as RLEs and so potentially registrable on a PSC register.

UK Entities Caught

As mentioned above, all UK companies, LLPs, certain Scottish partnerships and SEs are potentially subject to the PSC regime. Non-UK incorporated or registered entities are not caught though, of course, EEA-incorporated entities may be caught by similar regulations in their home jurisdiction imposed by the requirements of the 4MLD.

In general, the PSC rules are largely the same for companies (including SEs), LLPs and certain Scottish partnerships and so, save where expressly stated otherwise, for convenience in this note we refer just to “companies.” The UK has been required by the 4MLD to extend the PSC regime to Scottish partnerships (but not to English limited or general partnerships) because of their distinct legal status under Scottish law.

UK Entities Excluded from the PSC Regime

UK companies subject to ownership disclosure requirements under certain listing regimes which effectively provide the same public disclosure as would be required by the PSC regime—i.e. UK companies with voting shares admitted to trading on regulated markets in the EEA or on certain specified exchanges in the US (including NYSE and NASDAQ), Japan, Switzerland and Israel—do not have to keep a PSC register themselves and so are excluded from the PSC regime. Nevertheless, as mentioned above, these companies might in some cases find themselves having to be entered on another company’s PSC register as an RRLE. Also, even though these “listed” UK companies will not need to keep a PSC register themselves, their unlisted UK subsidiaries will still have to maintain their own PSC registers.

Previously, UK companies with shares traded on non-regulated UK markets (such as the London Stock Exchange’s AIM market) were also excluded from the PSC regime. However, following the implementation of the 4MLD, this exemption has been removed.

The PSC regime does not apply to other UK entities such as English limited partnerships or charitable incorporated organisations. As mentioned above, it also does not require any non-UK incorporated or registered entities to keep a PSC register, even if they have a presence or branch in the UK.

A PSC is an individual who meets at least one of the following conditions (the PSC conditions) in relation to a company (the conditions are different in relation to LLPs—see “What About Interests Held in LLPs” below):

holds, directly or indirectly, more than 25% of the shares,

holds, directly or indirectly, more than 25% of the voting rights,

holds, directly or indirectly, the right to appoint or remove directors holding a majority of the votes that can be cast at board meetings,

has the right to exercise, or actually exercises, significant influence or control over the company (the fourth PSC condition), or

has the right to exercise, or actually exercises, significant influence or control over the activities of a trust or firm which is not a legal entity and which meets any of the above mentioned conditions (the fifth PSC condition).

PSCs also include corporations sole (i.e. where the function of an office sits with a particular person), governments or government departments of any country or territory, international organisations whose members include two or more countries or territories or their governments and local authorities or local government bodies in the UK or elsewhere, in each case which meet any one of the PSC conditions.

People who are party to “joint arrangements” are treated as each holding their combined shares or rights. “Joint arrangements” is given a very broad meaning under the rules and includes understandings that are not legally enforceable and conventions, customs and practices of any kind. They must nevertheless have some degree of “stability.” Needless to say, companies (and potential PSCs or RLEs) could in particular cases find it very difficult to determine whether there are any “joint arrangements” in existence that could require interests to be combined for the purposes of the PSC conditions and registration on the PSC register.

This catch-all phrase, as used in the fourth and fifth PSC conditions, is designed to catch as PSCs individuals who have a controlling interest or influence in the company but who, because of the way in which their corporate ownership is structured, fall outside of the first three PSC conditions and so might otherwise not be regarded as PSCs.

Statutory guidance has been issued to help with interpreting this phrase (the latest guidance—for companies (there is separate guidance for LLPs and Scottish partnerships)—currently exists in draft form but should become final next month and can be found here). Non-statutory informal guidance has also been issued, both for PSCs and for companies, LLPs and Scottish partnerships, etc. in relation to the PSC regime. Links to all of this guidance are provided at the end of this note (see “Source of the Rules” below).

The statutory guidance provides an indicative, rather than exhaustive, statement of principles and a number of examples to assist in understanding the meaning of “significant influence or control.” Ultimately, whether someone can exercise “significant influence or control” in any situation needs to be assessed according to the particular circumstances. Significantly:

if a person meets one of the first three PSC conditions, it is not necessary to determine whether the person also satisfies the fourth PSC condition,

control and significant influence are alternatives - a person who can direct the activities of a company, trust or firm likely has control over it, whereas a person who can ensure that a company, trust or firm generally adopts certain activities likely has significant influence over it,

control and significant influence do not necessarily have to be exercised with a view to gaining an economic benefit,

a right to exercise significant influence or control would likely:

be inferred from a person having: absolute decision or veto rights regarding the running of the business of the company (e.g. adopting or changing the business plan), or absolute veto rights over the appointment of directors who hold a majority of the voting rights at meetings of the board, and

not be inferred from a person having veto rights regarding certain fundamental matters for the purpose of protecting a minority interest (e.g. changing the constitution, anti-dilution protection or on a winding up), or having on a temporary basis absolute decision or veto rights solely due to being the prospective purchaser of the company,

should be assessed with reference to all relationships the person has with the company or other individuals who have responsibility for its management to determine whether the cumulative effect of such relationships enables the person actually to exercise significant influence and control,

would likely exist if the person is significantly involved in the management and direction of the company (e.g. a person who is not a director, but regularly or consistently directs or influences board decisions, such as a shadow director), and

would likely exist if the person’s recommendations are always or almost always followed by shareholders who hold the majority of the voting rights when deciding how to vote (e.g. a company founder),

Indirect Holdings

If a PSC’s shares or rights in a company are all held indirectly through one or more legal entities (whether UK or foreign), the PSC will only have to be considered for registration in the PSC register if two conditions are satisfied:

the PSC has control over such entity(ies) in the sense of holding a “majority stake” (see below) in them, directly or through intermediate “majority stakes” held in entities forming a legal chain of ownership which ends with the UK company keeping the PSC register. Where, in the legal chain of ownership, only a minority stake is held, the link between the ultimate PSC and the UK company keeping the PSC register will be broken and the PSC will not have to be entered on the PSC register, and

none of those legal entities qualifies as an RLE (see below).

For these purposes, a majority stake in a company means:

having a majority of the voting rights,

being a member with the right to appoint or remove the majority of the board holding a majority of the votes that can be cast at board meetings,

being a member and controlling (alone or with others) a majority of the voting rights, or

being entitled to exercise or actually exercising dominant influence.

An RLE is a legal entity (UK or foreign) which:

if it had been an individual, would have satisfied one of the PSC conditions, and

is either: (i) a UK company subject to the PSC regime, or (ii) a UK or non-UK company subject to ownership disclosure requirements through being listed or traded on a UK or other EEA-regulated market or any of the US, Japanese, Swiss or Israeli exchanges mentioned above (see “UK Entities Excluded from the PSC Regime” above).

Indirect and Direct Holdings

An individual may have both a direct and indirect interest in a UK company keeping a PSC register. In that case, both interests will need to be aggregated to determine whether (and the extent to which) the individual is a registrable PSC in relation to the UK company. The same aggregation of interests may be required in the case of RLEs which have both direct and indirect interests in a UK company keeping a PSC register.

Holdings or Interests Held by Legal Entities Which Are RLEs

An individual does not have to be registered as a PSC in a company’s PSC register if the individual’s “controlling” position or interest in the company is held indirectly through one or more legal entities, at least one of which is an RLE. In this case, the company must reflect in its PSC register only the first RLE nearest to it in the chain (i.e. the RRLE).

Any companies in the chain between the RRLE and the company keeping a PSC register are ignored for registration purposes, as are any companies in the chain sitting above the RRLE, as well as, ultimately, any individuals with significant control over those companies (assuming they do not also hold direct interests which qualify them as PSCs in relation to the company keeping the PSC register).

As mentioned above (under “Indirect Holdings”), if one or more legal entities in the chain does not have a majority stake in the entity below it in the chain, the “indirect ownership” chain will be broken, and no RRLE or PSC will be registrable on the PSC register with respect to that particular “chain of ownership.”

Listed Groups of Companies With UK Subsidiaries

As indicated at the beginning of this note, where the UK company keeping a PSC register is a subsidiary in a group headed by a parent whose voting shares are listed or traded on any of the markets mentioned under “UK Entities Excluded from the PSC Regime” above, assuming there are no individuals exercising significant control directly over the UK subsidiary, that subsidiary will generally be required to enter in its PSC register as an RRLE, either its listed group parent or, if there is an intermediate holding company closer to it that qualifies as an RLE (e.g. a UK intermediate parent subject to the PSC regime itself), that intermediate holding company.

The example diagrams in the Annex illustrate how this all works.

What About Interests Held in LLPs?

As the nature of interests held in LLPs is different from interests held in companies, a PSC in relation to an LLP is an individual who meets at least one of the following conditions:

holds, directly or indirectly, the express right to share in more than 25% of any surplus assets of the LLP on a winding up (and if such rights are not express, each member is treated as holding the right to an equal share),

holds, directly or indirectly, more than 25% of the rights to vote on matters to be decided by the votes of members,

holds, directly or indirectly, the right to appoint or remove the majority of persons entitled to take part in its management,

has the right to exercise, or actually exercises, significant influence or control over it, or

has the right to exercise, or actually exercises, significant influence or control over the activities of a trust or firm which is not a legal entity, and which meets any of the above mentioned conditions.

What Must Be Done by Whom and Are There Penalties?

Taking Reasonable Steps to Maintain and Update the PSC Register

A company must take ‘reasonable steps’ to establish whether there are any registrable PSCs and RLEs in relation to it and, if there are, to identify them. It then has to enter certain prescribed information with respect to the existence (or not) of any PSC or RRLE in its PSC register, as well as certain prescribed particulars regarding any PSC or RRLE (see “Completing the PSC Register” below) within 14 days after it has all the required information. Reasonable steps are those that a reasonable person would take if he or she had the same information as the company, and will include reviewing available existing information and documentation (e.g. articles of association, shareholders’ agreements and voting patterns). If there are gaps in the information, it must send a notice to any person it has reasonable cause to believe should be recorded on its PSC register. Companies also have an obligation to keep their PSC registers up to date, to make enquiries for these purposes and to update their PSC registers within 14 days of having the required information to do that.

Penalties and Sanctions

If it fails to take steps and issue notices when required, both the company and any of its officers (directors) who are in default will have committed a criminal offence, punishable by a fine and/or up to twelve months’ imprisonment. No notices need be sent if the company already knows that someone needs to be registered as a PSC or RLE and all the information about them that needs to be shown on the register has been confirmed.

Further, anyone who knows or ought reasonably to know that it is a registrable PSC or RLE in relation to a company, is not recorded in the company’s PSC register and who has not received a notice from the company, has a duty to notify the company within one month of these conditions being satisfied of the person’s status, failure of which also makes that person guilty of a criminal offence. There is also an obligation on PSCs and RRLEs to notify a company of “relevant changes” in its particulars as recorded in a company’s PSC register.

A company has broad powers to facilitate compliance with the PSC regime. It can serve a notice on anyone it knows or has reasonable cause to believe knows the identity of a registrable PSC or RLE, or who knows the identity of someone else likely to have that knowledge, requiring them to respond within a month. This notice could, for example, be sent to family members or to professional advisors such as lawyers. A company can also impose restrictions on the shares or interests of a person who did not provide information in response to a notice it sent them. These restrictions would effectively prevent the person from selling or receiving any payment in respect of the interest while the information requested by the company has not been provided. The restrictions would be triggered by the issue of a restrictions notice which the company can issue after sending a warning notice. Aggrieved third parties can apply to court for a direction that certain acts may be taken despite the issue of a restriction notice, if such restrictions unfairly affect their rights in relation to those interests.

Completing the PSC Register

A company’s PSC register can never be blank. It must state, using prescribed wording: (i) the nature of control exercised or held by a PSC or RRLE, or (ii) that it knows or has reasonable cause to believe that there is no PSC or RRLE, or (iii) that it has not identified a PSC or RRLE that it nevertheless believes exists in relation to it, or (iv) that it has not had confirmed to it details of a PSC or RRLE it has identified, or (v) that investigations are ongoing with respect to finding out if it has any PSC or RRLE.

The particulars of a PSC that must be recorded in the PSC register include the name, address, country of residence, nationality and the date on which the PSC became registrable. Corresponding particulars of RRLEs must also be recorded in the PSC register. The information must be complete and confirmed before being entered on the register. There is a protection regime under which individuals can, in certain limited circumstances, apply for some or all of their information to be withheld from the register although, under certain limited circumstances, disclosure of that information is permitted to specified public authorities and certain credit or financial institutions

Source of the Rules

The PSC regime is set out in Part 21A of the Companies Act 2006 (which can be found here) as amended and/or supplemented by various regulations, including: (i) The Register of People with Significant Control Regulations 2016 (found here), (ii) The Limited Liability Partnerships (Register of People with Significant Control) Regulations 2016 (found here), (iii) The European Public Limited-Liability Company (Register of People with Significant Control) Regulations 2016 (found here), (iv) The Information about People with Significant Control (Amendment) Regulations 2017 (which can be found here and which have amended these earlier PSC regulations and Part 21A of the Companies Act 2006), and (v) The Scottish Partnerships (Register of People with Significant Control) Regulations 2017 (which can be found here). The various statutory and informal guidance, mentioned under “What Is Significant Influence or Control” above, can be found here.

Further Assistance

Should you have any queries or need further assistance, do not hesitate to contact one of the persons listed at the end of this note.

Conclusion

Analysing registrability under the PSC regime in certain private equity and funds structures will not always be easy or straightforward but in most other cases, especially for UK companies that are wholly owned subsidiaries of listed companies, this should not be overly complicated or difficult.

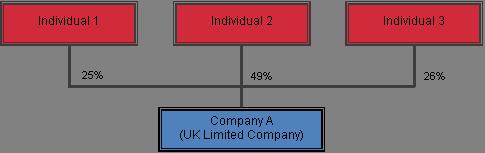

Example 1

Company A must record in its PSC register Individual 2 and Individual 3 as its PSCs, as they each hold more than 25% of its shares, thereby meeting the first of the PSC conditions. Individual 1 is not a PSC, as the individual does not meet any of the PSC conditions (assuming the individual does not have the right to exercise, or actually exercises, significant influence or control over Company A).

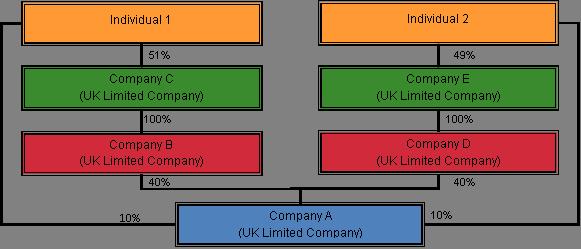

Example 2

Company A must record in its PSC register:

Individual 1, who has both a direct and indirect interest in Company A (counted because of the majority stake held in Company C, which in turn has a majority stake (100%) in Company B) which, when aggregated, results in Individual 1 holding more than 25% of the shares in Company A,

Company B, as it is the first RLE (having an interest of more than 25% in Company A) in the ownership chain nearest to Company A relating to Individual 1’s interest, and

Company D, as it is the first RLE (having an interest of more than 25% in Company A) in the ownership chain nearest to Company A relating to Individual 2’s interest.

It would not record:

Individual 2, who is not treated as having an indirect interest in Company A because the individual does not have a majority stake in Company E (and whose direct interest in Company A does not satisfy any of the first three PSC conditions, assuming the individual does not have the right to exercise, or actually exercises, significant influence or control),

Company C, as it holds its entire indirect interest via a majority stake in Company B, which is an RRLE, or

Company E, as it holds its entire indirect interest via a majority stake in Company D, which is an RRLE.

Companies B and D would record in their respective PSC registers Companies C and E as RRLEs. Companies C and E would record in their respective PSC registers Individuals 1 and 2 as PSC.

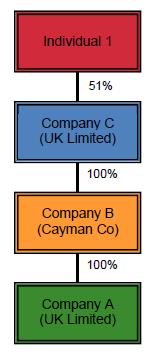

Example 3

Company A would record in its PSC register Company C as an RRLE, as it is the first RLE in the ownership chain nearest to it.

It would not record:

Individual 1 because, even though the individual holds an indirect interest in Company A (counted, as Individual 1 has a majority stake in Company C which, in turn, holds a majority stake in Company B), that interest is held through a chain of legal entities at least one of whom (Company C) is an RRLE, or

Company B, as it is not an RLE (i.e. not subject to any beneficial ownership disclosure obligations).

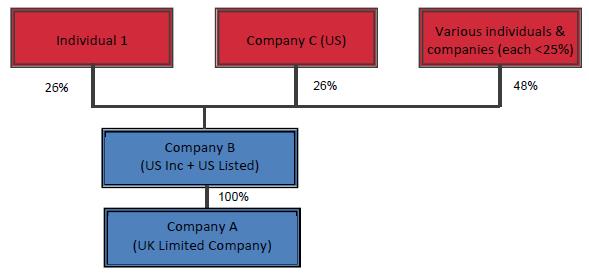

Example 4

Company A must record in its PSC register Company B as an RRLE. Individual 1 is not registrable in Company A’s PSC register as a PSC because of the registration of Company B as an RRLE. Company C and the other shareholders in Company B can be ignored for registration purposes for the same reason.

Industries