Jump to...

The European Commission has published draft legislative proposals which would require large non-EU banking firms with EU operations to establish an intermediate holding company in the EU. The proposed rules are similar to US requirements for certain non-US banking organizations to establish an intermediate holding company in the US. This note discusses the impact of the proposals on foreign banking groups and their restructuring plans, with a particular reference to US banks. It also considers the UK’s position in light of Brexit.

On 23 November 2016, the European Commission published legislative proposals to amend the Capital Requirements Directive and the Capital Requirements Regulation as well as other key pieces of EU banking legislation.[1] These include new proposals to require large non-EU banking firms to establish an intermediate holding company (“IHC”) in the EU. The proposal would not require subsidiarization of the EU banking operations of non-EU banks that are conducted through EU branch offices, although according to some commentators, that could still come about.

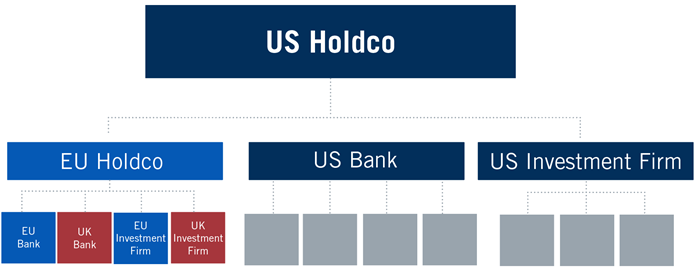

According to the Commission, this particular change is intended to ensure that the EU operations of foreign banks are sufficiently capitalized so that if the group fails there is enough capital locally to absorb the losses of the group’s European operations. However, it is widely regarded as retaliation to the US’s requirement for European banks to establish US IHCs which required many large EU-headquartered banks to undertake major restructurings at significant cost to maintain (non-branch) access to the US market. The Commission’s proposal would require non-EU banking organizations to hold EU non-branch bank and broker-dealer subsidiaries through a single EU IHC that would be subject to capital, liquidity, leverage and other prudential standards on a consolidated basis.

Large non-EU banking groups will need to analyze how to comply with the proposed new EU IHC requirements, in particular, any new governance or other prudential requirements, and remain in compliance with their home country’s rules too.

Where a non-EU banking group has two or more banks or investment firms established in the EU it would need to set up an intermediate EU parent undertaking above those entities. Firms within scope are those which are a non-EU G-SIB[2] or which have a total value of assets of more than EUR 30 billion in the EU. The total value of assets for purposes of this test takes into account the assets of the firm’s EU subsidiaries and its EU branches (even though branch assets are not required to be moved into the EU IHC). This is a much lower threshold than the US IHC rule, which establishes a $50 billion threshold and looks only at US non-branch assets because only non-branch assets are subject to being placed under a US IHC. The US IHC rule was widely viewed as addressing the capital position of large US broker-dealer subsidiaries of non-US banks because such broker-dealers were not otherwise subject to a risk-based and leverage capital regime administered by US prudential banking regulators. In contrast, EU broker-dealer subsidiaries of US bank holding companies are currently subject to Basel-based capital requirements.

The EUR 30 billion threshold mirrors the threshold under the Single Supervisory Mechanism for distinguishing between a “significant institution” and a “non-significant institution.” Significant institutions are subject to direct prudential supervision by the European Central Bank (“ECB”). It is also one of the proposed thresholds in the draft Regulation on structural measures for improving the resilience of EU credit institutions (the “draft EU Bank Structure Regulation”), which is yet to be agreed by the European Parliament and the Council of the European Union.

The EU IHC would need to obtain authorization as either a bank or investment firm or as a financial holding company,[3] triggering an authorization process. Either way, the EU IHC will become subject to the direct supervision of the relevant national regulator (or the ECB if the IHC is established in the Eurozone). This is due to the related proposed amendments to bring financial holding companies directly within scope of the EU prudential regime. Each banking group may only have one EU IHC. There is also the potential for regulatory approval being required for the acquisition of qualifying holdings. For recovery and resolution purposes, loss absorbing capacity would need to be held at the consolidated level of the EU IHC.

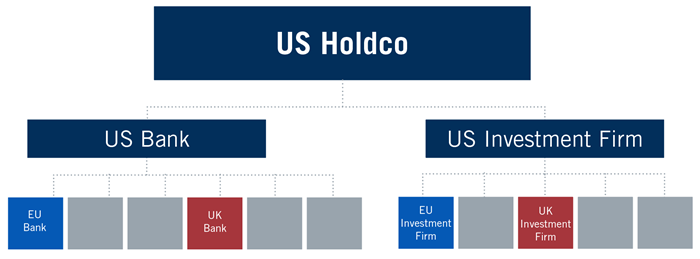

Large US bank holding companies operate in the EU through direct branch offices of their home country subsidiary FDIC-insured banks as well as through locally incorporated bank subsidiaries of those banks and, importantly, through broker-dealer subsidiaries that are often (but not always) owned by the bank holding company through a corporate chain separate from the FDIC-insured bank. There are strict limitations on transactions (including loans and other funding transactions) between the FDIC-insured bank (and its subsidiaries) on the one hand and its bank holding company parent and sister companies on the other. There are also limits on the securities underwriting and dealing activities of a broker-dealer subsidiary of a US bank, which can make it impractical or difficult to operate a large broker-dealer as a direct or indirect subsidiary of a US bank. Thus, the largest US bank holding companies operate their large US broker-dealer subsidiaries as sister companies of their FDIC-insured banks and often do the same with their non-US broker-dealer subsidiaries.

If a US bank cannot operate an EU broker-dealer subsidiary, a US bank holding company would need to transfer its EU bank subsidiaries so that they (and the broker-dealer) become indirect subsidiaries of the parent bank holding company in order to comply with the proposed EU IHC Rule. Doing so, however, would severely limit transactions between the US bank (including its EU branch offices) and the EU bank subsidiaries (as well as the other EU subsidiaries) of the US bank holding company.

Moreover, even if it were otherwise possible under the considerations addressed above to move all of the various EU bank and broker-dealer subsidiaries into an EU holding company under the US bank (and thus preserve the funding efficiencies of such a structure), other considerations, such as the swap push-out provisions of the Dodd-Frank Act (as amended), which prohibit US banks (and their subsidiaries) from engaging in certain types of structured finance swap transactions, would preclude the subsidiaries of the US banks from engaging in certain swaps businesses. This would again force all of the EU operations to be conducted outside of the chain of ownership of the US bank, thus triggering the funding limits described above.

This table sets out the main differences and similarities between the existing US IHC rules for FBOs and the Commission’s proposed EU IHC rules.

| US IHC RULES FOR FBOs | PROPOSED EU IHC RULES | |

| Scope | Despite different capital requirements regimes in the US for banking and broking, the US IHC rules for FBOs brought some broking into the bank capital rules by making the IHCs subject to bank capital rules on a consolidated basis and requiring the broking entities to become subsidiaries of such IHCs (which increased costs). | Applies to non-EU banking groups with two or more banks or investment firms established in the EU. Both banks and investment firms are currently subject to the same EU regulatory capital requirements legislation.[4] |

| Threshold | US non-branch or agency assets of US$50 bn or more. | A non-EU group that has two or more banks or investment firms established in the EU and that either: - is a non-EU G-SII; or - has total EU assets of at least EUR30 bn (subsidiaries and branches). |

| Applicable to all foreign G-SIIs | No, not automatic. | Yes, if the non-EU G-SII has two or more banks or investment firms established in the EU. |

| Single IHC requirement | Yes. | Yes. |

| Ownership interests / transfer requirements | Yes. Ownership interests in virtually all US bank and non-bank subsidiaries must be transferred to the US IHC. US branch and agency offices of non-US banks do not need to be transferred, rolled up or otherwise “subsidiarized.” | All bank and investment firm subsidiaries must be owned by the new EU IHC. There is no subsidiarization, transfer or roll-up requirement for EU branches on non-EU banking groups (yet). |

| Exceptions | US Federal Reserve may allow alternative ownership structures if applicable home-country law prohibits the FBO from controlling its US subsidiaries through a single IHC or where the activities, scope of operations or structure of the US subsidiaries justify an alternative structure. | Not specified. |

| Other requirements | A US IHC must comply with US Basel III leverage capital requirements, capital planning, stress testing, liquidity requirements and risk management requirements, such as establishing a risk committee. | Dependent on whether the EU IHC is authorized as (i) a bank or investment firm; or (ii) a financial holding company. |

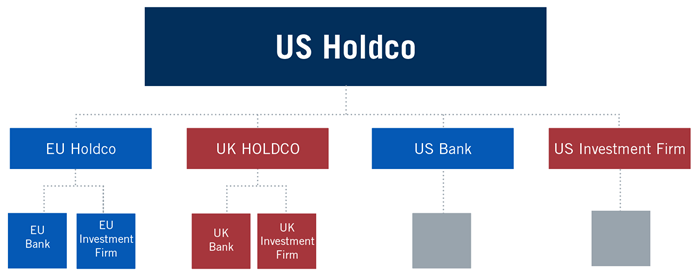

As with everything relating to Brexit, the timing of the proposals is key. The European Commission intends its proposed revisions to CRD IV to apply two years after finalization of the text. This means that CRD V, including the EU IHC proposal, is unlikely to be in force and applicable when the UK leaves the EU. Many non-EU banking groups will already be considering how to structure themselves post-Brexit to maximize opportunities and cost savings. The proposed EU IHC requirement is likely to add an additional layer of complexity to those deliberations. UK banking groups will also be considering the proposals given that after Brexit they too may become subject to those rules. UK and non-EU banking groups that are not a G-SIB and which have major EU operations may review the scope of their activities and consider reducing their balance sheets in the EU. This was one of the side effects of the US IHC requirements for FBOs. Non-EU G-SIBs will also need to consider how to structure their operations, including whether only one EU subsidiary is needed.

Other legislation on bank structure will also need to be taken into account, such as the draft EU Bank Structure Regulation which proposes that EU banks set up a ring-fence around their core deposit-taking activities to shield those deposits from the possible side effects of more risky trading activities. The UK’s ring-fencing rules, which are set to come into effect from 2019, are similar in intention and would also need to be considered.

It is questionable whether the UK will replicate the proposal (requiring yet another set of IHCs for the UK in addition to those for the EU). If the UK does not implement a similar measure or at least one that results in similar outcomes, there may be “equivalence” implications if the equivalence concept was extended to banking to allow access of UK banks to the EU and of EU customers to UK banks. However, a notable omission from the CRD V proposals is any extension of the equivalence regime for banking. In any event, the UK as an EU member state currently has the ability to influence the EU legislative debate on the EU IHC proposals.

The below diagrams are an illustrative example of a possible bank structure under existing requirements, the proposed EU IHC rules and then post-Brexit. The diagrams are not intended to show every possible structure and are not an indication of any mandatory structure.

A possible structure under CRD V + Brexit

[1] The proposals covered the Capital Requirements Regulation 575/2013, the Capital Requirements Directive 2013/36/EU (together, “CRD IV”), the Bank Recovery and Resolution Directive 2014/59/EU (the “BRRD”) and the Single Resolution Mechanism Regulation 809/2014. The proposals amending CRD IV are available here and the proposals amending CRR are available here. Those amending the BRRD on ranking of unsecured debt instruments in the insolvency hierarchy are available here and on loss-absorbing and recapitalization capacity of credit institutions and investment firms here. The proposals amending Single Resolution Mechanism Regulation are available here.

[2] The latest list of G-SIBs is available here.

[3] It is proposed that a new definition of financial holding company be introduced into CRR: “a financial institution, the subsidiaries of which are exclusively or mainly institutions or financial institutions, and which is not a mixed financial holding company. The subsidiaries of a financial institution are mainly institutions or financial institutions where at least one of them is an institution and where more than 50% of the equity, consolidated assets, revenues, personnel or other indicator considered relevant by the competent authority of the financial institution are associated with subsidiaries that are institutions or financial institutions.”

[4] The EU is at the early stages of considering a new framework for applying prudential standards to non-bank investment firms that are not deemed to be systemically important. The European Banking Authority published a Discussion Paper in early November on the topic, available here.