Sprung Link Text

On October 26, 2017, the European Commission (EC) announced a formal State aid investigation into a U.K. exemption from U.K. anti-tax avoidance rules for certain transactions by multinational groups, the so-called Group Financing Exemption. An adverse decision, even after the U.K. leaves the European Union (EU), could result in its removal and a retrospective charge on previously exempt profits plus interest.

The U.K. does not tax companies on the profits of their subsidiaries, whether foreign or domestic. Additionally, U.K. companies can deduct interest payments incurred on borrowing used to fund investments in domestic or foreign subsidiaries. Should a U.K. company, in determining the mix of debt and equity of its Controlled Foreign Company (CFC), overcapitalize it, U.K. funding costs could artificially replace the CFC’s funding costs, thereby diverting profits to the CFC.

The U.K.’s CFC rules allow HM Revenue and Customs (HMRC) to reallocate to a U.K. parent profits that were artificially shifted to an offshore subsidiary, thereby subjecting them to U.K. tax. The U.K.’s CFC rules were introduced in the 1980s, and similar rules are a feature of many other tax systems. All EU Member States are expected to introduce such rules by January 1, 2019, pursuant to the EU Anti- Tax Avoidance Directive.

The Court of Justice of the European Union (CJEU) stated in a judgment that the U.K. CFC rules were contrary to the EU fundamental freedom of establishment in cases where a CFC was established in a Member State of the European Economic Area (EEA) and where it was carrying out a genuine economic activity. This led to changes to the U.K. CFC rules, including the Group Financing Exemption.

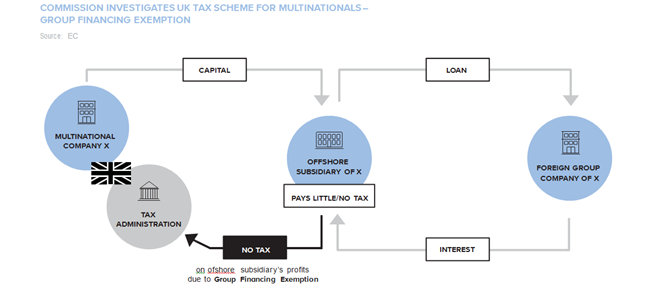

The Group Financing Exemption exempts from the U.K. CFC rules 75% of the finance income from intra-group loans between non-U.K. members of a U.K. headquartered group. The U.K. authorities justify this partial exemption on the basis that it is a reasonable proxy for the proportion of the finance that is ultimately provided from the U.K. A full exemption is available if the group is able to demonstrate that it is not funded by U.K. debt finance, but from its own local assets or new group equity capital. Without the Group Financing Exemption, the U.K. CFC rules would have reallocated the interest income to the U.K. parent company, where it would have been subject to U.K. tax.

The EC’s current view is that the Group Financing Exemption allows U.K. multinationals to avoid U.K. taxes by providing capital to a foreign subsidiary via an offshore subsidiary – which itself can be subject to little or no tax in that offshore jurisdiction. Due to the Group Financing Exemption, the offshore subsidiary’s financing income is not subject, or is only partially subject, to U.K. tax under the U.K. CFC rules.

The U.K. authorities justify the Group Financing Exemption on the basis that it would be very difficult to establish the extent to which an equity investment in a CFC has been sourced from U.K. borrowings incurred by a U.K. member of the corporate group, and that compliance costs would be overly burdensome. If the EC decides that the Group Financing Exemption does constitute illegal State aid, then those companies that benefitted from it could be required to pay tax to HMRC that would have otherwise been due, together with interest.

While there is no fixed legal deadline, the EC aims to conclude formal State aid investigations within 18 months. The EC has concluded past State aid investigations involving tax arrangements of Member States within shorter timeframes and is likely to be able to conclude this investigation prior to the U.K.’s planned departure from the EU on March 29, 2019.

The enforcement of, and any appeals against, an adverse decision would fall within the post-Brexit State aid arrangements between the U.K. and the EU, should such arrangements – transitional or otherwise – be agreed. While both the EU and the U.K. appear in favor of a post-Brexit State aid framework, should the U.K. and EU fail to agree on one, then it is possible that an adverse EC decision would be unenforceable.

EU Member States are free to determine the appropriate level of taxation in their jurisdictions, subject to certain exceptions, such as VAT. EU State aid rules, however, prohibit tax measures that grant selective advantages to specific businesses or sectors. In order to constitute State aid, a tax measure must, among other things, benefit certain businesses or sectors over others despite being in a comparable legal and factual situation. This selectivity test is vaguely defined and inconsistently applied, leaving the EC significant discretion to pursue various State aid cases it considers important.

There has been a concerted push at the political level in the EU to crack down on tax evasion and aggressive tax avoidance. For example, EU finance ministers agreed on a blacklist of tax havens in December 2017. The EC’s current investigation into the U.K. Group Financing Exemption can be understood in this context and is just the latest in a series of State aid tax investigations which include:

Since 2013, the EC has had a dedicated task force following up on public allegations of favorable tax treatment of certain companies (in particular in the form of tax rulings). Given the political impetus to confront tax evasion and aggressive tax avoidance and given the recent leaks to the media of such potential practices, further EC State aid investigations into EU Member States’ tax arrangements can be expected.

Regionale Erfahrung